working two jobs at the same time tax

In such case there cannot be two registrations that can be done. Your tax rate is based on your TOTAL income.

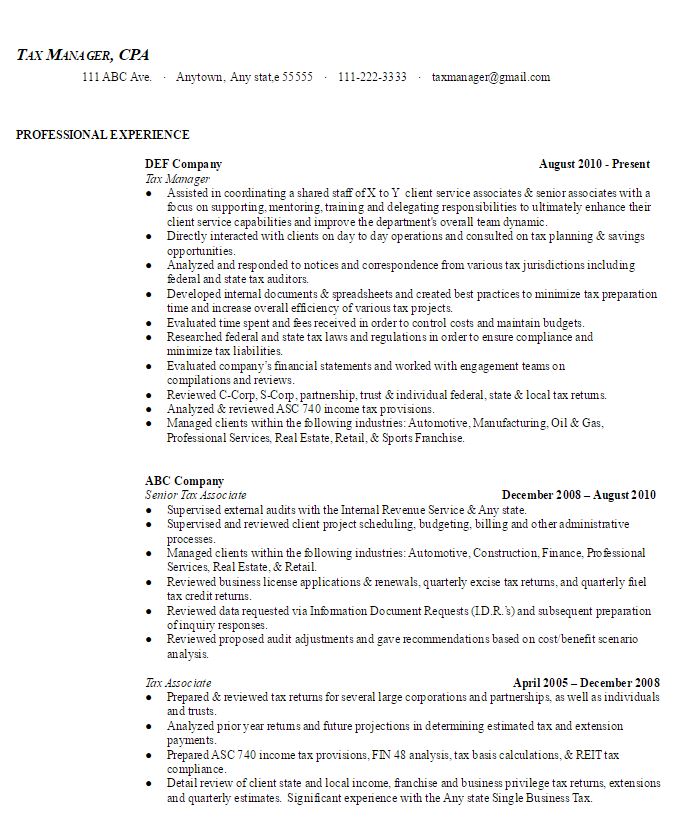

Sample Resumes Ambrion Experienced Search Consultants Accounting Finance Twin Cities

451 open jobs for Part time tax accounting in Los Angeles.

. As a general rule unless you work a job where you are on call or must be available 247 an employer wont terminate you for working a second job provided youre. How would I go about working two jobs at the same time. No it is not illegal to work with more than one company at a time in india.

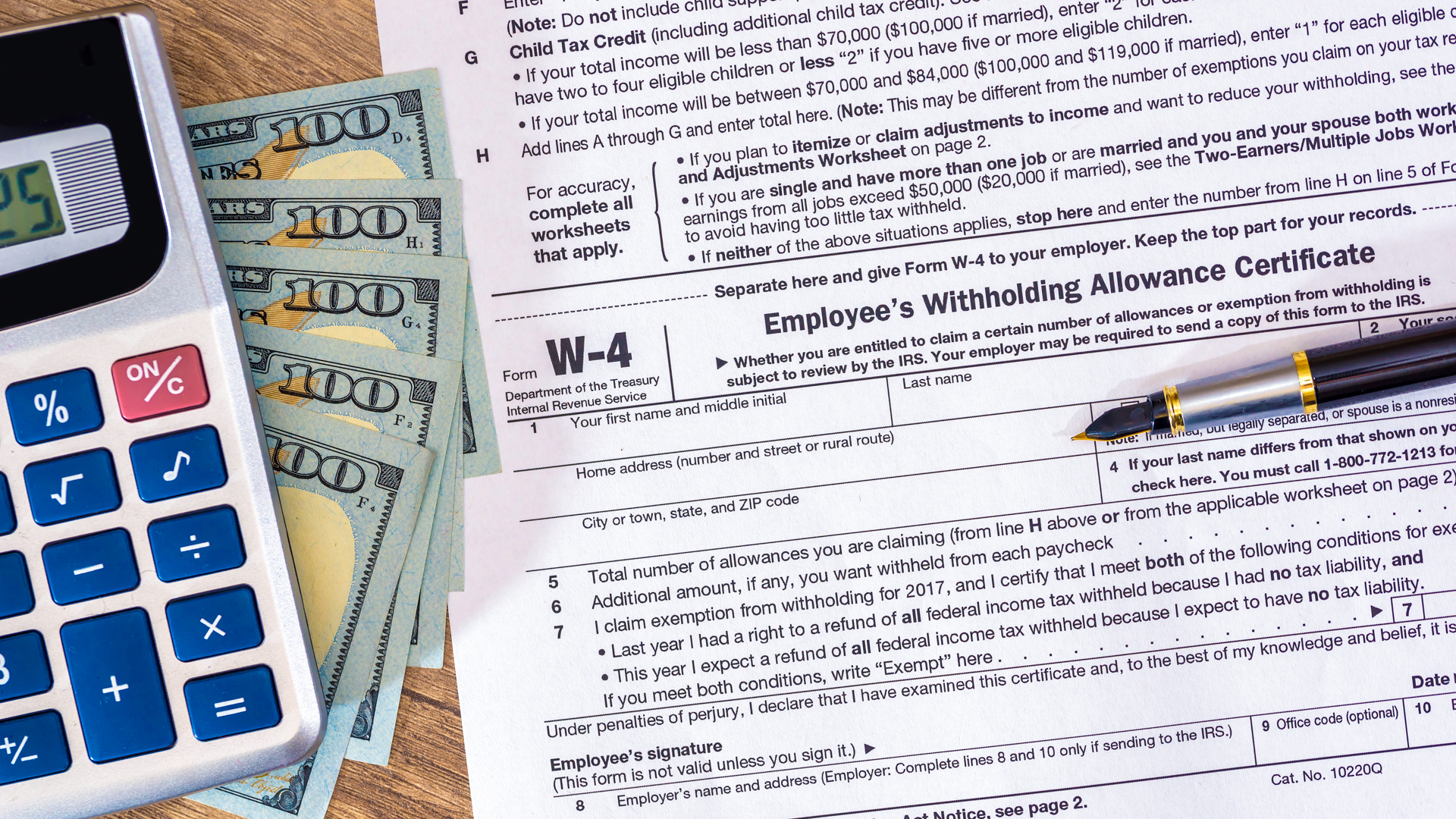

What forms would I fill out how do I fill out the W4 what other things should I be aware about etc. 73 open jobs for Part time tax consultant in Los Angeles. According to recent reports from Forbes the Wall Street Journal and Business Insider theres a new trend in remote work.

Search Part time tax accounting jobs in Los Angeles CA with company ratings salaries. But it does not. The Wall Street Journal checked the workers offer letters employment contracts pay stubs and corporate emails to see if they were being honest.

So if you worked 1 job and made 15k and worked another job and made 35k then youd be taxed by the government as if you worked 1 job and. This is called the Personal Allowance and is 12570 for the 202223 tax year. Infact a person can take up as many jobs as they want and can accommodate in their schedule.

Individuals who have more than one employer. You only get one Personal Allowance so its usually best to have it applied to the job paying you the most. If you receive income from two PAYE contracted positions wherein you have an employment contract with one limited company and are the director of your own at the same.

Search Part time tax consultant jobs in Los Angeles CA with company ratings salaries. That puts you in a 12 tax bracket for the 2022 tax year. Secondly to claim the benefits of PF contribution with two or more companies you will have to share the same UAN number.

Simultaneously and secretly holding down two. If you work in two or more jobs. As a Tax Consultant II you will work within an engagement team and draw on your experience in accounting and taxation to provide tax compliance and consulting services.

Suppose you take on a second job thats going to pay you an additional 10000 per year bringing your total annual. The Pay As You Earn PAYE system treats one job as your main employment. Revenue will give your tax credits and rate band to that job.

Lots of people have two jobs. Yes employees can work in Two companies at a time until they are able to manage the timings do the effective work and pay the income tax on both salaries if applicable. The current local time in Redwood City is 69 minutes ahead of apparent solar time.

Discover Job Tax Return S Popular Videos Tiktok

Does Working Two Jobs Reduce Your Tax Return Sapling

How To Fill Out A W4 2022 W4 Guide Gusto

How Do Taxes Work For Remote Workers It S Complicated Vox

W 4 Form What It Is How To Fill It Out Nerdwallet

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

W 4 Form How To Fill It Out In 2022

Sales Tax Deduction What It Is How To Take Advantage Bankrate

How To Become A Tax Preparer Your Complete Guide

Working More Than One Job Means More Tax Returns False Taxrise Com

Taking On An Extra Job Check Your Tax Low Incomes Tax Reform Group

How To Fill Out A W 4 A Complete Guide Gobankingrates

How To File Your Taxes And Tax Tips For Part Time Workers

Multiple Jobs Stock Photos Free Royalty Free Stock Photos From Dreamstime

Out Of State Remote Work Creates Tax Headaches For Employers

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

How To Fill Out Your W 4 Form To Keep More Of Your Paycheck 2019

Double Trouble Will Clients Have To Pay Taxes In Two Locations Accounting Today